SMCI Stock (2024): Is Super Micro Computer Worth a "Gamble Investment"?

If nothing major is found in BDO's audit, SMCI's stock may skyrocket 2-5x

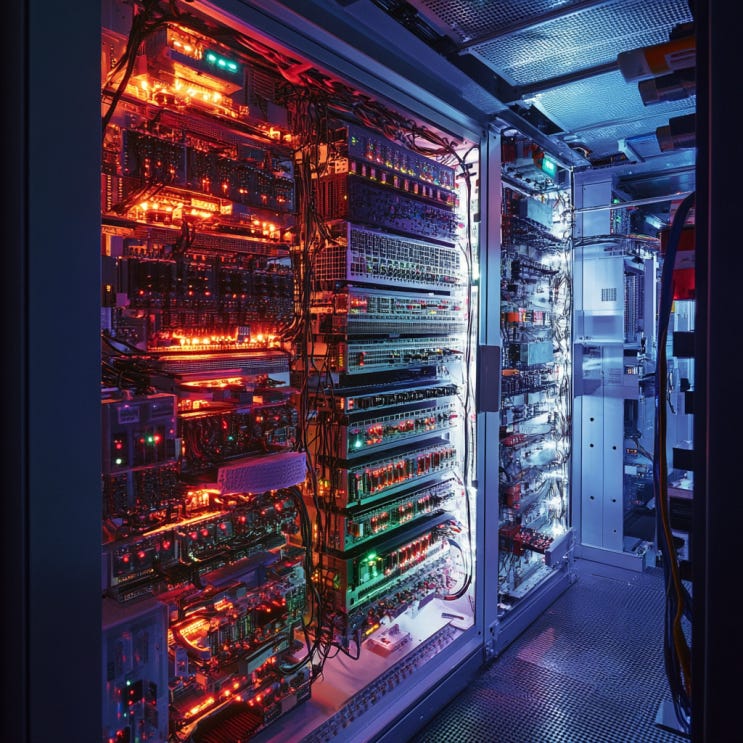

SMCI (Super Micro Computer Inc.) is a specialized server company that has been all over financial news for the past ~4 years (don’t confuse it with SMIC – the Chinese chip maker).

As a byproduct of insane AI server demand and SMCI’s dominant position in the AI server market (including partnerships with Nvidia) – its stock was one of the highest ROI investments from 2020-2024.

SMCI’s stock price exploded from under $3 at the start of 2020 to nearly $120 in 2024, with its market cap growing from ~$1.5B to over $62B (over 4000% ROI).

Everyone was drinking the SMCI hype juice… future’s-so-bright-gotta-wear-shades-vibes through Q1 2024, but negative news began percolating in Q2-Q3.

Negative news included:

A whistleblower lawsuit (April 2024)

Hindenburg Research alleging accounting manipulation (Aug 2024)

Delaying its annual SEC 10-K filing (Aug 2024)

U.S. DOJ probing Super Micro Computer (Sept 2024)

Ernst & Young (EY) dropping SMCI as a client (Oct 2024)

Talks of potential SMCI delisting from the S&P 500 and Nasdaq (Oct-Nov 2024)

Predictably, the snowball effect of negative news about SMCI’s alleged accounting fraud led the company’s stock value to nosedive under $20 (when it was nearly $120 just months ago) – with extremely high short seller interest (~16.23% of total shares & ~21.29% of publicly available float).

Some even joked about whether they should change their name to just “Micro Computer Inc.” because they were no longer “Super.”

Anyways, SMCI was required to find a new auditor (it found BDO) and extended its deadline to file its 10-K with the SEC (December 31, 2024) as part of an amended loan agreement with Cathay Bank.

This has led some (including myself) to contemplate whether SMCI might be worth a “gamble investment” (current price: $20-$30 with potential recovery price of: $60-$100 – could be a relatively easy 2-3x if pass audits).

SMCI’s Shady History of Violations (Timeline)

SMCI has a history of breaking rules and cooking books dating back to 2006.

1. 2006: Economic Sanction Violation

Issue: Exporting goods to restricted regions in violation of U.S. sanctions.

Penalty: $179,327 fine by the Office of Foreign Assets Control (OFAC).

Details: Super Micro was penalized for violating economic sanctions early in its operations. Specific case details were limited but involved improper exports.

2. 2014–2017: SEC Investigation into Widespread Accounting Violations

Issue: Premature revenue recognition, understated expenses, and misuse of cooperative marketing funds.

Details:

Revenue was improperly recognized for goods sent to warehouses or shipped before customer authorization.

Expenses, such as Christmas gifts and storage costs, were inappropriately allocated to cooperative marketing programs.

Former CFO Howard Hideshima knowingly signed misstated financial statements, bypassing internal controls.

Resolution: Financial restatements were made, and internal controls were enhanced.

3. 2018: Nasdaq Delisting

Issue: Failure to file financial reports for fiscal year 2017.

Details: The delisting stemmed from delays caused by investigations into accounting irregularities. Super Micro later relisted after filing corrected financial statements.

4. 2018–2023: Familial Loan Raises Governance Concerns

Issue: Charles Liang (CEO of Super Micro Computer) borrowed ~$12.9 million from his brother’s spouse Chien-Tsun Chang to repay margin loans (secured by SMCI stock) to 2 financial institutions after Nasdaq suspended SMCI stock.

Details:

In October 2018, Charles Liang borrowed approximately $12.9 million from Chien-Tsun Chang to repay margin loans secured by Super Micro stock.

The loan was unsecured, had no maturity date, and featured variable interest rates starting at 0.8% per month, later reduced to 0.25% per month by March 2020.

By June 30, 2023, the outstanding balance, including interest, totaled $16 million.

Familial ties complicate the arrangement: Chien-Tsun Chang is married to Steve Liang, Charles Liang's brother and the CEO of Ablecom Technology, a major supplier to Super Micro.

Charles Liang and his wife, Sara Liu, also own shares in Ablecom (10.5% as of 2023).

Impact:

The informal terms of the loan (e.g., no security or maturity date) and overlapping family and business relationships raised concerns about corporate governance and potential conflicts of interest.

Occurred during a period of significant challenges for Super Micro, including its NASDAQ delisting in 2018 due to financial reporting issues.

5. 2020: SEC Settlement on Prior Violations

Issue: Continuation of accounting violations identified between 2014–2017.

Details: The SEC completed its investigation, confirming deficiencies in internal controls over financial reporting.

Settlement:

Civil fine: $17.5 million imposed by the SEC.

CEO Clawback: Charles Liang reimbursed $2.1 million in stock profits under Sarbanes-Oxley clawback rules.

CFO fines: Former CFO Howard Hideshima paid $300,000 in disgorgement, $50,000 in fines, and a cease-and-desist order for his role in circumventing internal controls and signing misstated filings.

6. 2024: Renewed Allegations & Investigations

Whistleblower Lawsuit (April 2024)

Issue: Former employee alleged ongoing accounting manipulation and export control violations.

Details: Premature revenue recognition and rehiring of individuals involved in prior infractions. Claims of unauthorized exports to sanctioned regions like Russia post-2022.

Hindenburg Research Report (August 2024)

Issue: Allegations of accounting manipulation, undisclosed related-party transactions, and sanctions evasion.

Details: Highlighted sales overstatements and related-party transactions involving entities linked to CEO Charles Liang's family. Exposed potential violations of U.S. export controls, including sales to Fiberhome, a Chinese state-owned entity on a U.S. watchlist.

Impact: Stock price plunged over 20% in two days; broader market concerns triggered lawsuits and investigations.

Class Action Lawsuits (August–October 2024)

Issue: Securities fraud allegations by shareholders.

Details: Claims of overstated sales, understated expenses, and misleading financial disclosures. Lawsuits covering infractions from February 2021 to September 2024.

Ernst & Young Resignation (October 2024)

Issue: Ernst & Young resigned as the company's auditor, citing an inability to rely on management’s representations.

Impact: Triggered another 30% drop in stock price and raised investor concerns over governance.

DOJ Investigation (September 2024)

Issue: Focus on accounting violations, export control breaches, and related-party transactions.

Details: Triggered by whistleblower allegations and the Hindenburg report. Potential criminal liability pending findings.

Specific Violations Reported in SMCI’s Past

Premature Revenue Recognition and Reporting: This refers to recording revenue before the company has completed the actual sale or delivery of goods/services, violating accounting standards.

Premature Revenue Recognition Prior to Customer Delivery: Revenue is recorded before the product or service has been delivered to the customer, which misrepresents the company's financial health.

Improper Recognition of Revenue Upon Shipment of Goods Without Customer Authorization: Recording revenue when goods are shipped without obtaining prior authorization or agreement from the customer.

Improper Recognition of Revenue Upon Shipment to a Large Super Micro Customer (And the Parties’ Shipping Terms Required Revenue to Be Recognized Upon Delivery): Revenue was recorded at the time of shipment instead of delivery, contrary to the agreed shipping terms with the customer.

Improper Recognition of Revenue Before Obtaining Customer Acceptance: Revenue was recognized before the customer formally accepted the product or service, which could lead to disputes or reversals.

Improper Recognition of Revenue Upon Shipment of Goods That Were Incomplete or Misassembled: Revenue was recorded for goods shipped in a defective, incomplete, or misassembled state, even though they could not be used as intended by the customer.

Improper Recognition of Revenue Upon Shipment to a Large Super Micro Distributor: Revenue was prematurely recognized when products were shipped to a distributor, possibly before meeting delivery or contractual requirements.

Improper Recognition of Revenue While Holding Customers’ Bills of Lading: Revenue was recorded even though the company retained the shipping documents (bills of lading), suggesting the goods had not yet been delivered.

Failure to Properly Account for Extended Warranties: The company failed to correctly allocate or defer revenue for extended warranties, which should be recognized over the warranty period.

Misuse of Cooperative Marketing Funds: Marketing funds provided by partners or suppliers were misused, possibly recorded incorrectly or spent on unauthorized activities.

Overvaluation of Inventory: The company inflated the value of inventory on its balance sheet, which could mislead stakeholders about the company's financial position.

Keep reading with a 7-day free trial

Subscribe to ASAP Drew to keep reading this post and get 7 days of free access to the full post archives.