Palantir (PLTR) Stock Analysis: Fair Value & Price/Buy Targets (Feb 2025 Update)

Is Palantir (PLTR) worth buying at these high valuation multiples? It's not as "overvalued" as many think, but it's certainly not "undervalued."

Palantir Technologies Inc. (PLTR) is a company co-founded by Peter Thiel in 2003 that specializes in big data analytics and AI solutions via operating systems for customers with 2 main software platforms:

Gotham: An AI/ML platform optimized for government clients that compiles massive datasets to generate highly-specific recommendations for optimal plans for military orgs to achieve highest odds of success for missions. Essentially it’s providing the U.S. gov with an unfair advantage over other countries and criminal organizations (all of this is great).

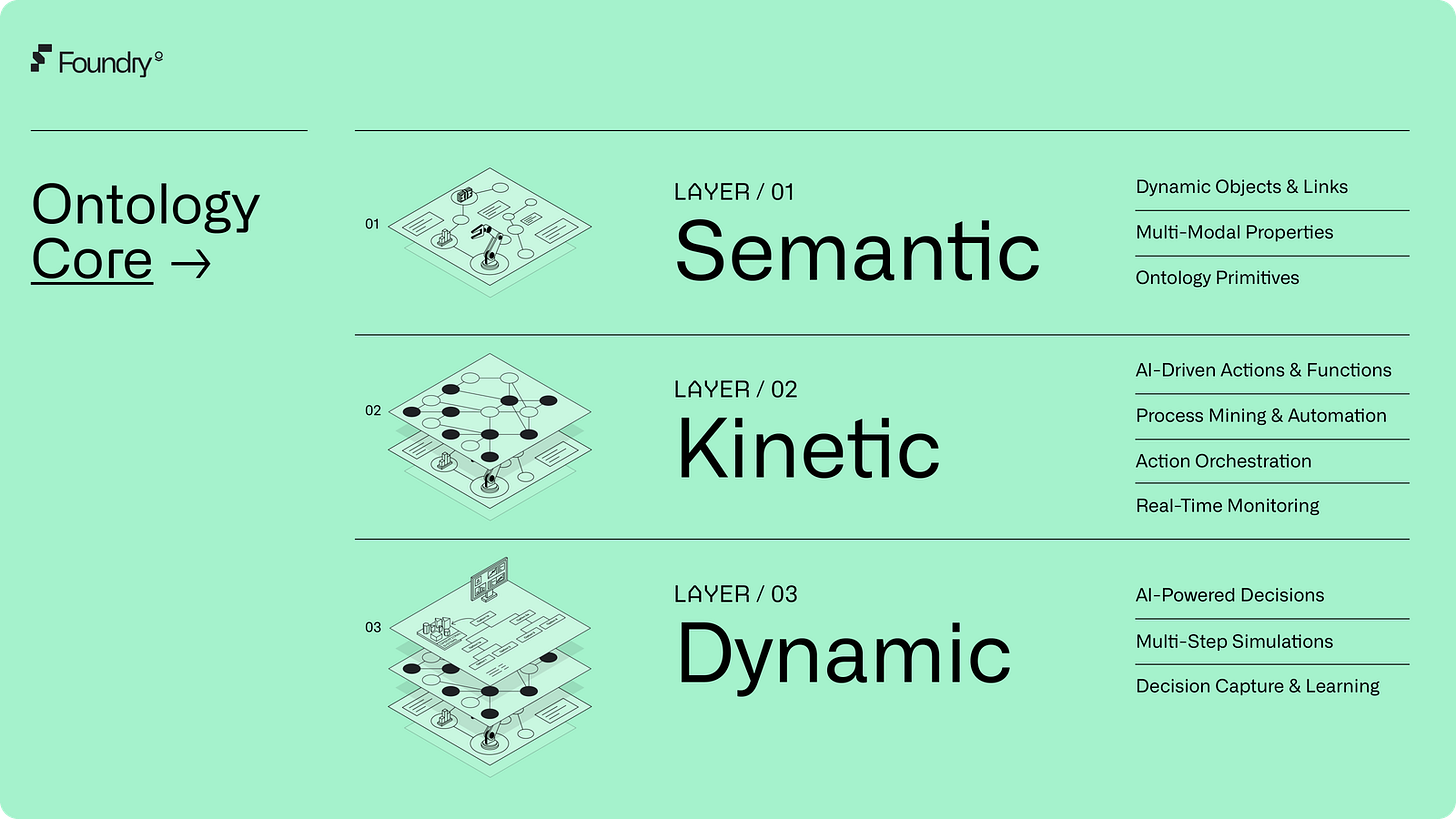

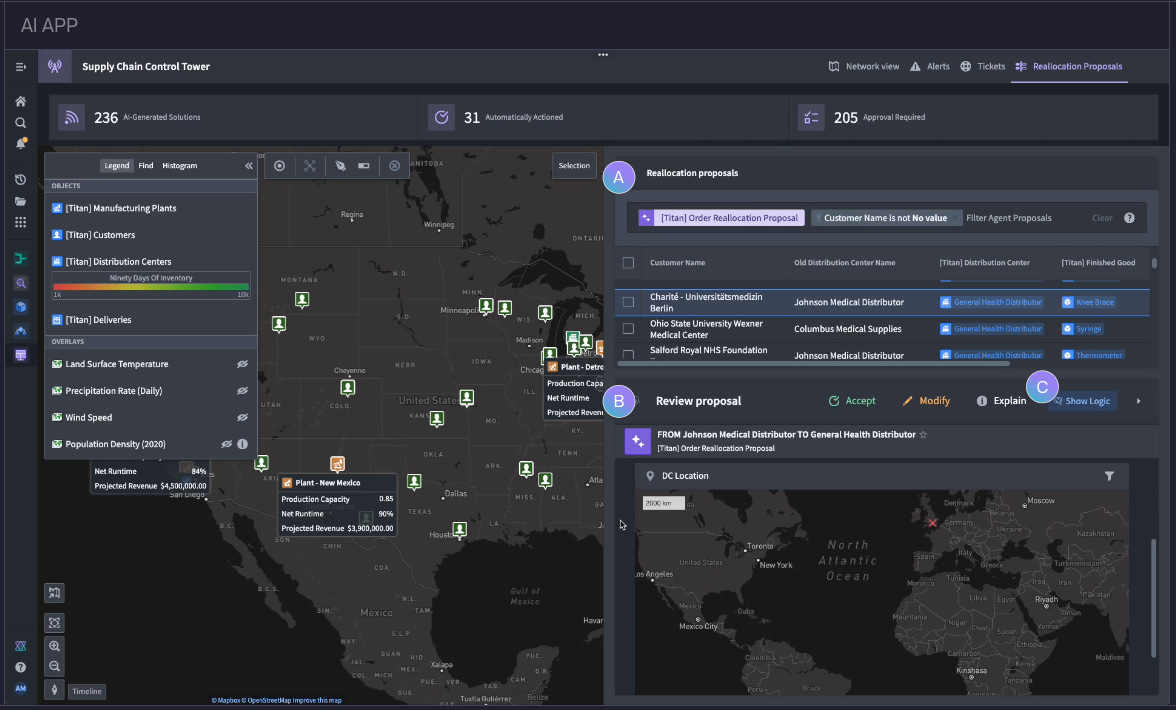

Foundry: An AI/ML platform focused specifically on helping businesses better understand their company data and streamline operations. If you’re running a biz, Foundry allows you to integrate all data into a single AI model that you can then build, train, and deploy in day-to-day processes. All data is completely protected and stays internal to the company. (Foundry competitors include: Databricks, Snowflake, et al.)

Note: PLTR also has platforms called “Apollo” (infrastructure that powers Gotham and Foundry via software deployment) AND “AIP” (integrates LLMs within PLTR’s existing platforms for AI-enhanced decision making).

These days most people know of Palantir (PLTR) because it’s: (1) up ~1100% over the past 5y; (2) up ~342% over the past 1y; (3) using big data AI/ML (the buzz); (4) advanced AI for the U.S. military; (5) co-founded by Peter Thiel & Alex Karp; and (6) promoted on social media by a cohort of cult-like retail investors.

The Palantir bulls basically imply the company has insane unrealized upside given the potential for both Gotham and Foundry to expand (particularly the latter in the non-gov biz sector) and claim that nobody understands it cuz “ontology layer bro.”

The ontology layer provides a unified semantic framework, enhanced data integration, provides better insights for decision making, advanced AI analytics, scalability, and currently has little to zero competition… so the ontology layer bros are probably on to something.

The Palantir bears imply that sure the company may be great and doing some good stuff, but the valuations are mindboggling and make zero sense. These are the types who are generally laser-beam focused on traditional valuation metrics (e.g. PE, PS, PEG, PB, etc.).

On X the other day I saw some viral post from a value investor comparing Palantir (PLTR) to Nike (NKE) with the following: (A) PLTR: $2.8B rev, MC: $252B, PM: 16% vs. (B) NKE: $49B rev, MC: $101B, PM: 10%.

I’m not a fan of investing in clothing companies because it’s mostly just psychology (the actual clothes aren’t usually much better than competitors… so you need to convince people to to buy yours with social psychology/marketing, etc.).

Anyways, the comparison above makes it seem like PLTR is massively overvalued. If you ONLY FOCUS ON VALUATION METRICS, Palantir looks like a truly retarded buy.

But NKE has much lower moat, is currently in questionable social standing (after going ultra-woke), may be affected by tariffs, etc. — whereas PLTR is a booming AI/ML company with a big moat, gov contracts, and massive unrealized potential (TAM).

The value investing crowd typically fails to consider potential upside (unrealized TAM)… which is fine, but a direct “value metric” comparison to a company like Nike is completely disingenuous and bad faith. (And no I’m not implying NKE won’t rebound here… I’m just suggesting this comparison is highly simplistic/flawed.)

Disclaimer: Nothing here is financial or investment advice.

Palantir (PLTR) Earnings Report (Q4 2024)

Total Revenue: $828M, +36% YoY and +14% QoQ

U.S. Revenue: +52% YoY, driven by both commercial (+64% YoY) and government (+45% YoY)

Customer Count: +43% YoY (including +73% YoY in U.S. commercial customers)

Adjusted Income from Operations: $373M; 45% margin

Adjusted Free Cash Flow: $517M; 63% margin

Rule of 40: 81%

Net Dollar Retention: 120% (expanded usage from existing customers)

FY 2024 Revenue: $2.87B (+29% YoY), with a 39% adjusted operating margin

Guidance for FY 2025: ~31% revenue growth, implying $3.74B–$3.76B range, well ahead of prior Street expectations

Interpretation

Palantir is showing continued rapid growth in the U.S. commercial segment (64% yoy in Q4) and robust government traction (45% yoy).

Its high free cash flow margins (63% in Q4) and 120% net dollar retention underscore strong adoption and expansion.

Management is also guiding for ~31% revenue growth in 2025, suggesting that the “AI tailwinds” (particularly around its AIP—Artificial Intelligence Platform) remain a major catalyst.

Palantir (PLTR) Stock Valuation Metrics (Feb 2025)

Early in 2025 PLTR seems to be doing well… it fits within “U.S. Defense & AI Contractors” category which ranked as the top sector in my article Top 10 Best Investments for 2025.

Here are 4 high-level metrics that many analysts might look at, highlighting both Palantir’s promise and its lofty valuation.

1.) PS Ratio (~87)

Palantir’s Price-to-Sales near 87 is extraordinary, even among fast-growing AI software names (where 20–40 is already high).

Indicates the market is pricing in substantial long-term upside.

2.) Forward PE (~200+)

Palantir’s forward P/E ratio above 200 highlights minimal near-term EPS relative to its market cap ($260B+).

Investors are clearly betting on future profitability expansions, not current earnings.

3.) EV/EBITDA (~724)

Enterprise Value to EBITDA ratio nearing 700+ is extremely high by standard software norms (where 30–50 can be normal).

Suggests Palantir is viewed as a long-horizon AI platform rather than a typical software vendor.

4.) Free Cash Flow Yield (~0.4–0.5%)

Palantir’s FCF margin (~40%) is excellent in absolute terms.

But with such a large market cap, the FCF yield remains under 0.5%, implying a rich price for each FCF dollar.

Interpretation: These multiples confirm Palantir is trading at top-tier valuations, well above typical enterprise software. The company’s strong free cash flow, large net-cash position, and ~30% growth outlook support some premium—but any material slowdown or intense AI competition could trigger multiple compression.

Palantir (PLTR): Base Case, Bull Case, Bear Case (5-Year Scenarios: 2025-2030)

Included below are estimated probabilities and potential returns from the current share price (~$114). These reflect Palantir’s top-tier fundamentals vs. its high valuation risk.

A) Bull Case (~25% Probability)

Palantir emerges as a de facto AI “operating system” across Fortune 500+ government agencies.

Revenue growth holds in the mid-30%+ range, with GAAP margins climbing steadily.

SBC (stock-based comp) dilution moderates.

5-Year ROI: +130–180% → share price heading into the $260–$320 range.

Rationale: The market effectively “crowns” Palantir as the clear AI platform leader, more than justifying current multiples.

B) Base Case (~55% Probability)

Consistent ~25–30% annual revenue growth, with continued traction in commercial/gov segments.

Healthy FCF margins remain high (35–40% adjusted).

Valuation multiples remain elevated but not at extremes.

5-Year ROI: +60–90% → stock in the $180–$215 range.

Rationale: Palantir grows strongly but not explosively; competition emerges, yet Palantir retains a differentiated edge. Multiples compress somewhat, but the stock still outperforms typical software names.

C) Bear Case (~20% Probability)

AI/data competition from big cloud players intensifies, slowing Palantir’s new deals.

Government budgets flatten or become uncertain.

15–20% revenue growth is still “good,” but well below the 30%+ the market bakes in.

5-Year ROI: –30% to –40% → share price could slip to $70–$80.

Rationale: Overly optimistic market expectations meet reality, leading to multiple compression if Palantir’s momentum sputters.

Palantir Fair Value Estimate (Feb 2025)

I’ve created a framework customized for Palantir to determine “fair value” for the stock for those with a 5y investment horizon.

I estimate a fair-value range that accounts for:

Business fundamentals: How is the core biz of PLTR functioning?

Future expansions: Considering how PLTR might grow, how quickly, etc.

I take into account Palantir’s robust fundamentals (high FCF margin, net cash, ~30% near-term growth) and risks from exceedingly high multiples (PS ~87, EV/EBITDA ~724).

My internal framework (involves highly-specific metrics, complex weightings, and calculations) yields a “fair value” range between:

Keep reading with a 7-day free trial

Subscribe to ASAP Drew to keep reading this post and get 7 days of free access to the full post archives.