Why NBA Ratings & Viewership Decline (2024-2025)? Cord Cutting. Other Reasons Mostly BS

Many are blaming "boring basketball" and "too many 3-pointers" when it's mostly just cord-cutting...

Every year, when NBA television ratings slide, the same tired scapegoats surface: “It’s all those three-pointers!” or “Fans hate the politics!” or “Players are too soft—no one plays defense!”

Sure, these arguments might pique attention on sports talk shows, but they mask the real reason the NBA’s measured viewership is plummeting: cord-cutting and media fragmentation.

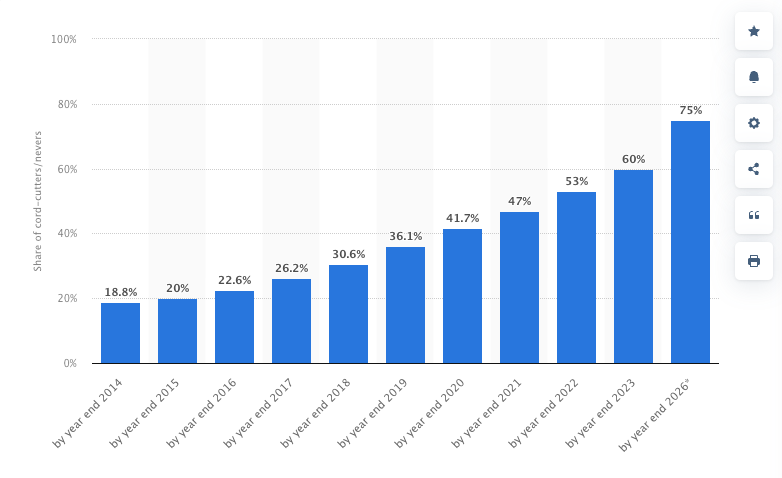

Over the last decade, cable and satellite subscriptions have hemorrhaged millions of households. In 2015, around 76% of U.S. households still had cable; now it’s closer to 56%, with projections hitting 72% cord-cutters by 2025.

Meanwhile, unauthorized (and untracked) streaming has exploded, as fans seek free, high-quality alternatives in a world where official rights are scattered across multiple networks and apps.

So if you think the NBA’s rating slump is all about “boring basketball,” you’re missing the biggest piece of the puzzle: the collapse of traditional pay TV.

Cord-cutting dwarfs all other explanations for the NBA’s abrupt TV decline… blaming “too many threes” or “woke politics” is basically ignoring the forest for the trees.

Recent Declines in NBA Ratings

2024-25 Season

Viewership has dropped 19% compared to the previous season (2023-2024) across ABC, ESPN, and TNT. When including NBA TV, the decline reaches 25%.

Some reports suggest a smaller 3% overall decline when factoring in December's recovery and international viewership.

Interestingly, the NBA’s 2024 Christmas Day games hit viewership records relative to other years despite competition with the NFL (which also hit NFL viewership records).

2023-24 Season

The average viewership was 1.59 million per game, slightly down from 1.61 million in the 2022-23 season.

Long-term Trends

Since the 2011-12 season, NBA ratings have fallen by nearly 50%, dropping from 2.5 million viewers per game to approximately 1.4 million in the current season.

Cord-Cutting: The Main Cause of NBA Viewership Decline

A.) Core Stats & Drivers

Decline in Pay-TV Households

Dropped from over 100 million in the early 2010s to just 58 million in 2023.

This exodus robs the NBA of millions of potential linear-TV viewers.

Key Drivers

Rising Costs: Cable bills can exceed $200/month, while cord-cutters save around $70. (“Cable was too expensive” is the top reason most people cut the cord in the U.S. — a reason for ~73%) (LINK)

Fragmentation: Multiple streaming services create subscription fatigue, pushing many fans away from cable.

Demographic Shifts: Younger, tech-savvy viewers (and Hispanic immigrant communities) often skip expensive cable bundles in favor of cheaper or free digital options.

Technology: High-speed internet and easy-to-use streaming apps make it simple to watch content outside of cable.

B.) Correlation with NBA Rating Drops

Between 2015 and 2021: Cable penetration fell by ~20 percentage points (from 76% to 56%).

NBA TV Ratings: During a similar window, major network broadcasts lost up to 19% in some seasons, contributing to an overall 18–25% decline.

While other variables can momentarily boost or reduce viewership, the parallel between cable’s collapse and the NBA’s rating slump indicates a strong structural relationship.

Recent data also shows that streaming now accounts for 40+% of all TV consumption, surpassing cable’s ~30%. That transition inherently siphons off traditional TV watchers.

C.) Illegal Streaming as a Complementary Force

Shift from Downloads to Streams: By the late 2010s, 80%+ of digital piracy was tied to streaming rather than downloads, reflecting better broadband speeds and user-friendly pirate sites.

Recent Growth: Visits to piracy websites rose 12% between 2019 and 2023, hitting 141 billion total visits last year. Surveys suggest 19–35% of NBA fans have turned to unauthorized streams at least once—none of which is captured in Nielsen metrics.

Impact on Measured Ratings: Cord-cutters who still want to watch the NBA often opt for illegal HD-quality streams, reinforcing the measurable “decline” in legitimate, trackable broadcasts.

Combined, cord-cutting and illicit streaming could plausibly explain at least 35–40% of lost TV viewers, dwarfing any single on-court complaint. (Could be even more substantial than this.)

Other Reasons NBA Views Down

On-Court Style (3-Point Mania, Softer Defense): Yes, some fans dislike the perimeter-heavy game. However, if “boring offense” was the main culprit, the drop would’ve been more significant in years past.

Political Messaging & “Wokeness”: A vocal subset claims activism drove them away. Yet the NFL and MLB feature similar social messaging and remain strong in linear TV.

Load Management: Frustrating for existing fans, but it doesn’t account for the mass disappearance of cable households.

Competition from NFL & Soccer: True, the NFL dominates prime sports windows, and soccer’s rising popularity draws some niche fans. Nonetheless, the NBA coexisted with football for decades when cable was healthier.

82-Game Grind & Overload: Excessive regular-season inventory can dilute urgency. But that alone can’t explain a massive multi-year rating slump.

Each factor may alter how or when certain fans watch, but none systematically eliminates the possibility of even accessing NBA games—cord-cutting does.

Modifying the Gameplay Probably Won’t Significantly Boost NBA Viewers

Many fixate on style-of-play or star rest, but ignoring the data on cable’s implosion borders on willful blindness.

The NFL also changed rules to favor offense without sacrificing massive viewership. Political controversies exist in multiple leagues that remain healthy on cable (NFL is as woke as it gets).

Meanwhile, the NBA’s largest single driver of lost ratings is the tens of millions of homes that no longer carry ESPN or TNT to begin with.

When up to 72% of U.S. households may be cord-cutters in 2025, it’s pure delusion to think banning the 3-pointer or silencing politics will resurrect linear TV numbers.

People aren’t skipping the NBA because they find it dull; they’ve just ditched cable.

Implications & Responses

Unified Streaming Access: The NBA might partner with a major OTT platform or launch an affordable, blackout-free package to unify fan access. This approach can mitigate subscription fatigue and dissuade piracy.

Accurate Measurement: Relying on Nielsen’s linear metrics is inadequate. The NBA needs modernized data—counting streaming (legal and possibly unauthorized) to gauge real engagement.

Demographic Outreach: Younger Americans and many immigrant groups are less inclined to pay for cable. Bilingual broadcasts, cost-friendly streaming tiers, and robust social content can attract them.

Rule Tweaks Alone Won’t Fix Ratings: Minor changes to on-court play may please some fans, but they do nothing to reclaim the giant portion of households that no longer have cable.

Final Take: NBA Views Are Mostly Down from Ditching Cable TV (Not the Other BS)

If you still insist that the NBA’s ratings drop is about “boring basketball” or “woke politics,” you’re willingly ignoring the hard data. Cord-cutting has gutted cable’s once-massive reach, scattering fans across Netflix, TikTok, YouTube, and a sea of illegal streams. No wonder linear numbers are in freefall: those households simply aren’t there anymore.

Yes, on-court style influences some fans, and controversies can alienate a minority, but those pale compared to the structural meltdown in pay TV. Until the NBA confronts the new media reality—streamlined access, fewer blackouts, modern measurement—tweaking the game or banning star rest is putting a band-aid on a severed limb.

Bottom line: Dumping on 3-point shooting or political messaging is a cop-out for lazy analysts. The real fight is about distribution: how to get eyeballs in a post-cable world. Until that’s resolved, expect more think pieces bemoaning “the NBA’s downfall”—all while ignoring the actual cause: the unstoppable tide of cord-cutting.