AMD & George Hotz (TinyCorp, TinyBox, TinyGrad) Angling to Chip Away at NVIDIA's CUDA Moat (2025)

Will AMD & George Hotz (tinygrad) finally crack NVIDIA's CUDA moat?

A lead GPU software engineer, Anush Elangovan, recently posted on X about “working closely” with George Hotz and his company “tinygrad” with intent to "help commoditize the petaflop.”

A subset of AI/ML/tech nerds were hype seeing Anush responding to the “AMD YOLO” blog post from George Hotz and the fact that AMD seems to be finally embracing its collab with Hotz despite a somewhat rocky relationship to date.

AI classifying the X responses to Anush’s X post…

Excitement/Enthusiasm:

Forrest (@m_forrest): "Yo finally"

yezos (@yeeeeezos): "LETS GOOOOO"

Fareesh Vijayarangam (@fareesh): "Let's go!"

Positive/Supportive:

Ryan Gury (@rgury): "Congrats George!!"

Yucheng L (@lycfyi): "huge respect!"

Kaushik Iska (@iskakaushik): "Good move Anush!"

Sasha White (@musashigarami): "Finally this is brilliant news!"

Relief/"Finally":

Kimmono (@kimmono): "Finally!!!"

Patricio Lobos (@strandedinoslo): "Finally!"

Ἀρχιμήδης (@arXmedes): "Finally !"

Overdue/Criticism of Delay:

Abdellah Ht (@drht_): "glad you finally caved!"

Amne (@backgamemnon): "About time!"

Atomic Fuss (@AtomicFuss): "Took you long enough, tbf"

Financial/Stock Related:

Sciumo (@SciumoInc): "this is a stock indicator btw"

Liran Ringel (@liranringel): "OK, buying AMD stock"

Numan (@NumanThabit): (References prior bearish prediction on AMD)

Speculation/Opinion:

Param Aggarwal (@paramaggarwal): "Someone above you forced your hand."

Yannick Oscar (@yannickoscar_): "A fork in the road"

Analysis/Questions:

RajPattem (@pattem_raj): "Whats your comments on this development? Is there a good chance for AMD in race with NVIDIA?"

RELATED: Can NVIDIA maintain an edge in the inference-first era (2025-2030)?

George Hotz: “AMD YOLO” Blog Post (March 2025)

Just read what George had to say (it’s short): AMD YOLO.

AMD passed George Hotz’ “cultural test.” He believes they won’t “shoot themselves in the foot on software.”

This led him to conclude that there’s no reason “NVIDIA should be worth 16x more.” He also speculated: “either NVIDIA is super overvalued or AMD is undervalued.”

He also claimed “CUDA isn’t really the moat people think it is, it is just an early ecosystem.”

George claims tiny corp has a fully soverign AMD stack (rewritten the full stack from hardware to PyTorch with the exception of LLVM and soon they’ll port it to MI300X).

He says the hardware is similar (seems fairly accurate) and he’s betting on AMD being undervalued and that demand for AI has barely started (perhaps Jevon’s paradox).

He claims: “With good software the MI300X should outperform the H100.”

And? He’s got some skin in the game… prob bought $250K of AMD stock and plans to hold it for a 5-year time horizon (2025-2030). Not a bad bet regardless of whether AMD manages to penetrate NVIDIA’s moat.

It’s also cool that Hotz et al. at tinycorp are in position to influence the trajectory of AMD.

Hotz, AMD, and Early Friction

Who Is George Hotz? (“GeoHot”)

George Hotz made his name as a teenager by unlocking the first iPhone and later hacking the PlayStation 3.

These feats demonstrated his prodigious reverse-engineering skills and penchant for confronting walled gardens.

Hotz eventually turned his attention to autonomous driving (through Comma.ai) and AI hardware, founding Tiny Corp to pursue his vision of affordable, high-performance computing.

A Rocky Start with AMD

I think they started collaborating circa 2022-2023? But the collab hasn’t been that smooth to date. Seems like they’re now trying to get things back on track.

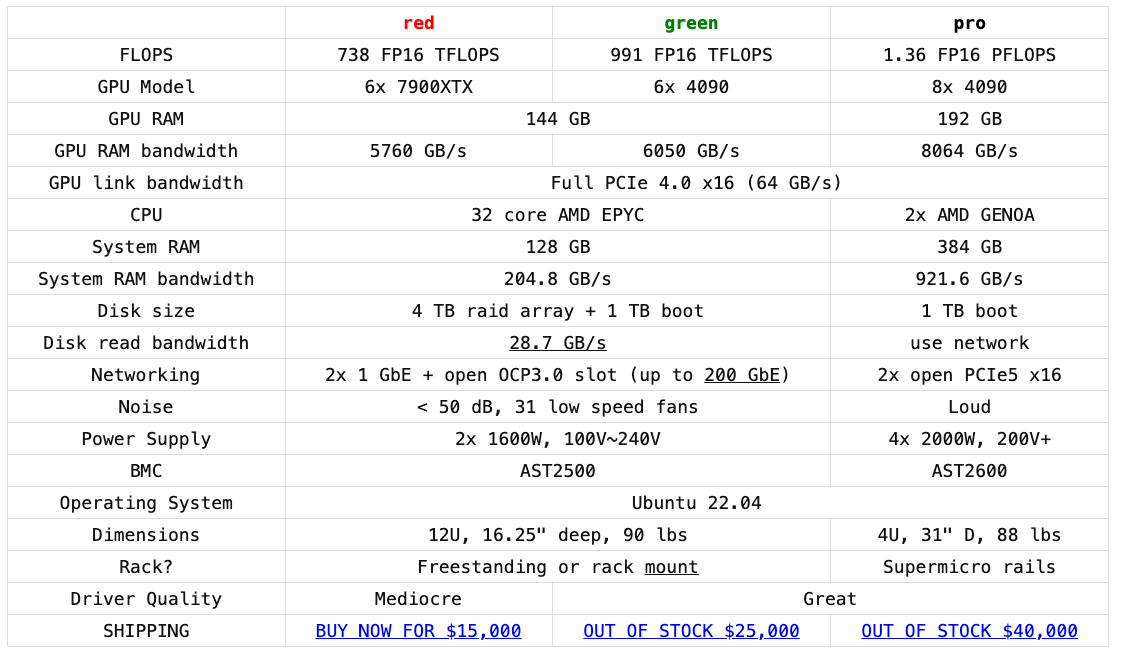

Tiny Corp’s flagship product, TinyBox, re-purposes consumer gaming GPUs—like the Radeon RX 7900 XTX or the NVIDIA GeForce RTX 4090—into a cost-effective AI server. Selling at $15,000 (AMD-based) or $25,000 (NVIDIA-based), the TinyBox aims to deliver “petaflop-class” performance at a fraction of the enterprise GPU costs.

Early on, however, Hotz’s team faced consistent stability challenges with AMD’s firmware and driver stack:

Closed-Source Firmware: AMD refused to open crucial firmware blocks (MES/CP), making it difficult for developers to debug or fine-tune performance.

Delayed Software Patches: Despite assurances from AMD’s leadership, critical fixes arrived slowly, prompting Hotz to publicly lament, “We are not AMD’s QA team.”

Limited ROCm Maturity: AMD’s official compute platform, ROCm, lagged behind NVIDIA’s CUDA in terms of documentation, library robustness (e.g., cuDNN), and overall developer adoption.

By late 2024, the tension grew so severe that Tiny Corp paused shipments of the AMD-based TinyBox. Hotz threatened to pivot to Intel Arc or consolidate on NVIDIA GPUs—unless AMD delivered genuine progress on open firmware and driver stability.

TinyBox & Tinygrad: Keys to “Commoditizing the Petaflop”

The TinyBox Concept

Tiny Corp’s flagship product, TinyBox, is a 12U rack server designed to combine 6 consumer-grade GPUs into a powerful AI training node. Rather than spending $30,000 or more on an enterprise-class GPU (e.g., NVIDIA’s H100), a team can purchase a TinyBox at:

$15,000 for an AMD-based configuration (6× Radeon RX 7900 XTX).

$25,000 for a higher-end NVIDIA GeForce RTX 4090 version.

With each TinyBox boasting “petaflop-class” FP16 performance, the goal is to slash the cost of entry for AI research and enable more widespread experimentation with large language models (LLMs), mixture-of-experts systems, and other compute-heavy tasks.

Tiny Box supplies:

High FLOPS at Lower Cost: Up to ~750–1000 FP16 TFLOPS, depending on GPU choice.

Peer-to-Peer PCIe Interconnect: Allows direct GPU-to-GPU data transfers without overwhelming the CPU.

Open-Source Frameworks: tinygrad—Hotz’s minimalistic deep learning library—alongside PyTorch and JAX, pre-installed on Ubuntu 22.04.

Tinygrad

Central to Hotz’s strategy is tinygrad, his open-source deep learning framework.

Minimalist Design: Unlike large, monolithic frameworks, tinygrad aims for a lean codebase that can be rapidly debugged, understood, and extended.

Hardware Portability: Tinygrad includes backends for AMD, NVIDIA, and potentially other accelerators. By aligning with AMD’s hardware at a low level—often bypassing or heavily modifying AMD’s default ROCm drivers—tinygrad can unlock performance or stability that wasn’t feasible with stock software.

Synergy with PyTorch: Over time, tinygrad has grown to support or interoperate with popular AI frameworks like PyTorch and JAX. This approach eases adoption by developers who want CUDA-like performance but prefer open-source transparency or cost savings.

In short, tinygrad is the software linchpin that could let Hotz transform AMD’s raw GPU potential into real-world AI performance, minus the licensing constraints of NVIDIA’s CUDA.

What about AMD’s ROCm Stack?

AMD’s official ROCm ecosystem (including HIP, rocBLAS, etc.) provides a partial, if underdeveloped, equivalent to NVIDIA’s CUDA.

Tiny Corp leverages some ROCm components but has heavily customized or replaced layers of the driver stack to bypass firmware limitations and deliver more direct GPU control.

Some labs might run both ROCm and TinyBox software in tandem, but increasingly, Hotz’s “fully sovereign AMD stack” could function independently of AMD’s official software if it proves more performant and stable.

March 2025: A Surprising Turn of Events

The “AMD YOLO” Post

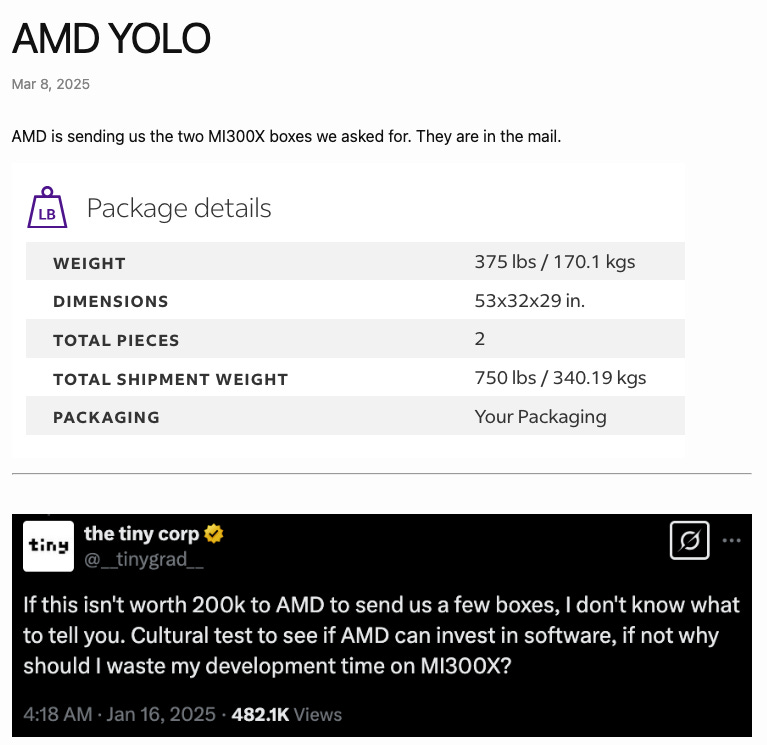

On March 8, 2025, Hotz published a blog entry—dubbed “AMD YOLO”—revealing that AMD had sent him two MI300X data-center GPU systems for integration into TinyBox.

More significantly, AMD’s Vice President of AI Software, Anush Elangovan, publicly praised the move on social media, stating they look forward to “help commoditize the petaflop” through tinygrad.

This change in tone signaled AMD’s growing commitment to transparency and software maturity.

Why AMD Embraced Tiny Corp

Firmware Documentation: AMD finally released more open documentation for RDNA 3/4 firmware, allowing deeper debugging.

Growing AI Market: With AI demand at historic highs, even a fraction of NVIDIA’s customer base represents massive revenue potential.

Hotz’s Track Record: Despite his unorthodox style, Hotz’s public breakthroughs often generate buzz and ecosystem adoption, potentially uplifting AMD’s image as a viable AI player.

Nature of the Collaboration

This renewed partnership appears more like a tactical alliance than a formal, long-term joint venture.

AMD provides early hardware samples, partial source-code access, and engineering support; Tiny Corp uses its agile open-source approach to optimize the software stack.

Both sides stand to gain if the resulting solution matches or exceeds NVIDIA’s performance.

Potential Implications for AMD

A Boost to AI Credentials

Historically, AMD has struggled to match the software polish of NVIDIA. Should Tiny Corp’s modifications result in near-CUDA-level performance on AMD GPUs, it would demonstrate that AMD’s hardware shortfalls in AI have been more about suboptimal drivers than inferior silicon. This could:

Accelerate AMD’s Data-Center Market Share: Enterprise and cloud providers may at least evaluate AMD-based solutions if they become cost-competitive and stable.

Encourage Developer Adoption: A robust open-source stack can appeal to research labs hungry for transparency and cost savings.

Tighter Feedback Loop

One of Hotz’s biggest critiques was that AMD’s engineering had an outsource-heavy approach, causing slow bug fixes and miscommunications.

If AMD’s new “open firmware” policy and direct developer channels with Tiny Corp remain consistent, they’ll benefit from real-time feedback on driver issues.

The company could iterate firmware updates faster, shedding its reputation for sluggish patches.

Potential Challenges

Maintaining Momentum: AMD must continue supporting firmware openness and quick-turnaround driver improvements. A single major lapse could undermine trust.

Market Skepticism: Some HPC or enterprise buyers remain skeptical, remembering AMD’s past slow cycles. Overcoming inertia requires showcasing stable and repeatable AI benchmarks under production loads.

Will this impact NVIDIA’s CUDA moat?

It really depends whether AMD can penetrate the CUDA moat and simultaneously release GPUs with the same caliber of hardware.

NVIDIA is all-gas-no-brakes. It’s possible that Hotz and his tinycorp team can put a dent in CUDA, but this may be a far bigger challenge than excited AMD investors believe… they need hardware parity AND to crack CUDA or NVIDIA continues to steamroll.

NVIDIA’s CUDA Stronghold

NVIDIA’s true moat lies in its CUDA ecosystem, refined since 2006, replete with libraries like cuDNN, cuBLAS, and advanced profiling tools.

Most AI labs already have code, personnel, and workflows steeped in CUDA, making any switch a costly endeavor.

Erosion Over Time

If TinyBox with AMD GPUs demonstrates real-world performance parity (or near-parity) at a lower price, smaller AI labs and cost-sensitive startups might adopt it incrementally.

Over time, a growing user base means more open-source tools and success stories, reinforcing AMD’s viability:

Pilot Deployments: Labs test AMD-based TinyBoxes on specialized tasks or large language models requiring high VRAM.

Success Stories: Positive results—such as top-tier papers published—could inspire wider adoption, eventually encroaching on NVIDIA’s dominant share.

NVIDIA’s Likely Countermoves

NVIDIA might respond by discounting hardware, offering new licensing structures, or unveiling next-generation features (e.g., advanced Tensor Cores, HPC software). Such moves are designed to keep developers firmly rooted in CUDA and discourage serious AMD experimentation.

Why the Higher Confidence in AMD now?

Visible Commitment: AMD shipping MI300X boxes and collaborating publicly with Tiny Corp shows a willingness to address developer concerns in real-time.

Open-Source Momentum: Communities often improve open-source tools faster than a closed, in-house team can. Hotz’s “cultural test” suggests AMD is finally aligning with open development principles.

AI Demand Explosion: With hardware shortages and rising GPU prices, an AMD-based solution that works well is no longer a mere curiosity; it can be a pragmatic choice for many.

The Future: Opportunities & Caveats

Opportunities

Expanded Developer Ecosystem: A robust AMD stack cultivated by Tiny Corp could attract hundreds of contributors, rapidly maturing the platform.

Cost-Sensitive Adoption: With startups eager for cheaper high-performance compute, even a 10–15% share shift from NVIDIA to AMD can be a major milestone.

Impact on AMD’s Valuation: Greater AI market confidence could push AMD’s stock upward, closing the valuation gap with NVIDIA.

Caveats & Open Questions

Long-Term Stability: Does AMD have a plan to keep firmware consistently open and well-documented beyond short-term improvements?

Enterprise HLAs (High-Level Agreements): Will major cloud players (AWS, Azure, Google Cloud) adopt AMD-based solutions at scale, or will inertia favor NVIDIA? Most big players need bulletproof reliability.

Tiny Corp Scalability: Hotz’s team is relatively small. If demand skyrockets, can they provide the needed support and services?

Final Take: George Hotz x AMD (March 2025)

George Hotz’s renewed phase with AMD in March 2025 — evidenced by Hotz’ “AMD YOLO” post with MI300X shipments, a $250K investment in AMD stock, hype reactions in AI/tech circles, etc. — are positive news for AMD.

Many have complained for years that AMD is horrendously bad at optimizing its software and/or not even trying to compete with NVIDIA’s CUDA. I guess this gives people some hope. I think it’s a massive uphill battle, but GLHF.

Some are betting AMD will be a “multi-bagger” as a direct result of Hotz & tinycorp. AMD’s stock is down ~47% over the past 1y… yet the company achieved record annual revenue & high profits in 2024 with significant growth in their data center segment.

AMD experienced slower-than-anticipated growth in AI chip sales though… and revenue forecasts slowed and price targets from analysts were downgraded (which doesn’t necessarily mean too much).

That said, most investors want the hottest hand: NVIDIA x Jensen Huang. NVIDIA outpaced AMD in segments that investors value most (AI/ML). All dry powder was injected into NVIDIA… NVDA has a cult-like following and is fairly popular among retail YOLOers (all money/eggs in the NVIDIA basket — zero diversification swag).

And just because NVIDIA is valued ridiculously higher than AMD does NOT guarantee AMD catches up. Some were bullish AMD prior to the renewed Hotz x TinyCorp x AMD news in March 2025… this should make them a bit more bullish.

Do I think AMD’s stock is a better investment than NVIDIA with the Hotz x TinyCorp collab? It’s better than nothing… I own some AMD so fine with me if they do well. I’m not sure how much this collab will move the needle though.

If I were advising AMD I’d say they need to poach more high IQers and take feedback from the tech community re: software optimization more seriously. Perhaps the tech community is delusional about their advice for AMD and AMD knows this (IDK).

Final thought: Although NVIDIA’s CUDA ecosystem seems like an impenetrable fortress, it’s worth keeping an eye on what TinyCorp & George Hotz can do with the AMD collab.

More roadblocks? Gaining some ground? Or fast-track to CUDA parity?